Interest rates continue to dominate conversations among Calgary homebuyers — and understandably so. Higher borrowing costs impact affordability, approval amounts, and overall confidence. But Calgary’s housing market doesn’t behave the same way as other major Canadian cities, and the effect of interest rates here is far more nuanced.After more than 20 years in Calgary real estate and over 1,850 homes sold, I’ve watched interest rate cycles come and go. And while rates definitely influence buyer sentiment, they don’t dictate Calgary’s market the way many assume.Here’s a clear breakdown of how interest rates are actually impacting Calgary buyers today, based on the most recent 2025 data.

Interest rates continue to dominate conversations among Calgary homebuyers — and understandably so. Higher borrowing costs impact affordability, approval amounts, and overall confidence. But Calgary’s housing market doesn’t behave the same way as other major Canadian cities, and the effect of interest rates here is far more nuanced.After more than 20 years in Calgary real estate and over 1,850 homes sold, I’ve watched interest rate cycles come and go. And while rates definitely influence buyer sentiment, they don’t dictate Calgary’s market the way many assume.Here’s a clear breakdown of how interest rates are actually impacting Calgary buyers today, based on the most recent 2025 data.Calgary Responds Differently Than Other Canadian Markets

Rising interest rates cooled several major markets across Canada — but Calgary has remained one of the most resilient real estate markets in the country.Why?Because our fundamentals are strong and continue to drive real demand:- Population growth: Calgary saw 23,000+ net new residents in Q1 2025 alone.

- Affordability advantage: Even with rate hikes, Calgary remains one of the most affordable big cities in Canada.

- Economic strength: A diversifying job market continues to attract workers.

- Lifestyle appeal: Family-oriented communities, lake access, walkability, and amenities are a huge draw.

- New supply vs. demand gap: Even with inventory increasing, demand continues to absorb available homes.

Calgary’s fundamentals influence what buyers do.

And those fundamentals remain strong.

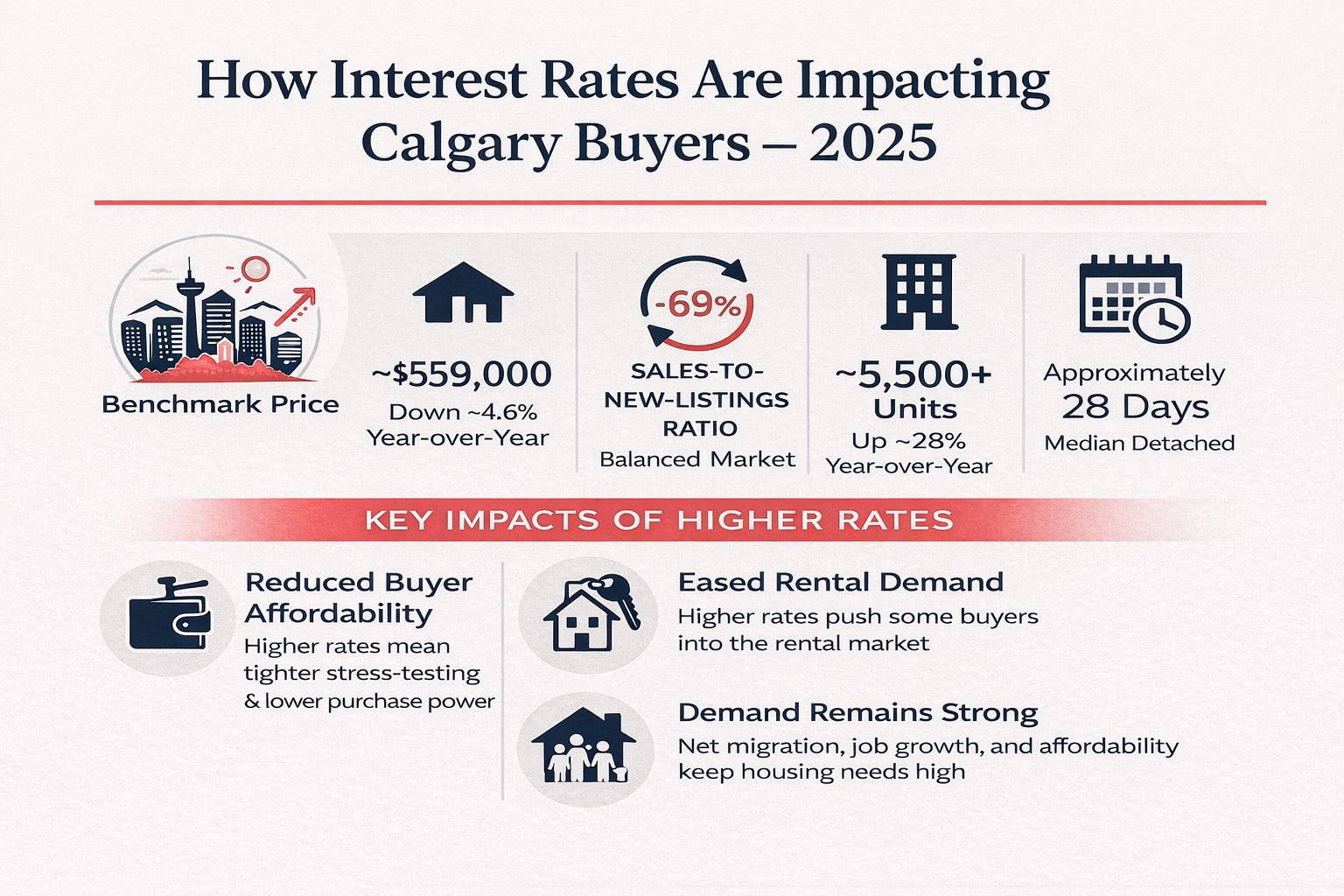

The Latest 2025 Calgary Housing Data

Here’s what the most recent numbers show:- Benchmark Price: ~$559,000, down about 4.6% year-over-year

- Inventory Levels: 5,581 active listings, up 28% year-over-year

- Sales-to-New-Listings Ratio: Approximately 69% (balanced market)

- Months of Supply: Roughly 3–4 months, depending on segment

- Days on Market: Trending longer, with detached homes around 28 days

- Rental Vacancy Rate: 4.6%, easing rental pressure

- Net Migration: Continues to lead the country, reinforcing baseline demand

Calgary has shifted into a balanced, stable market, even with higher rates.

How Interest Rates Are Affecting Buyer Affordability

Higher rates impact buyers in two major ways:1. Reduced Purchasing Power

Mortgage stress testing means buyers must qualify at rates higher than their contract rate. This lowers approved amounts and pushes some buyers into different price brackets.2. Higher Monthly Payments

Even if prices soften slightly, higher rates often result in similar — or higher — monthly payments.But here’s the key insight most buyers overlook:Price drops rarely offset the effect of higher interest rates.

Even a 3–5% price reduction typically doesn’t compensate for the cost of borrowing at significantly higher rates. This is why many buyers who wait end up paying more overall when rates eventually drop and prices rise again.Why Calgary Isn’t Seeing a Major Price Correction

Despite rising inventory, Calgary is not entering a downturn. Here’s why:1. Migration Is Keeping Demand High

Tens of thousands of people are relocating to Calgary annually, fueling both rental and purchase demand.2. Affordability Keeps Buyers Active

Even with higher rates, Calgary remains far more affordable than Toronto or Vancouver.3. Builders Can’t Add Enough Supply

New communities like Mahogany, Rangeview, Auburn Bay, and Alpine Park are growing — but not fast enough to match long-term demand.4. Balanced Market Conditions Support Stability

With months of supply hovering around the 3–4 mark, Calgary sits in balanced territory — not in oversupply.Rates can cool the market, but they haven’t reversed Calgary’s long-term trajectory.What Buyers Should Do Right Now

Based on today’s data and buyer behavior, here’s the strategy I recommend:1. Understand Your True Monthly Affordability

Work with your lender to map out payments under various rate scenarios.2. Compare Resale vs. New-Build Options

With strong builder relationships and extensive SE community experience, I can help you weigh which path fits your lifestyle and budget best.3. Focus on Communities With Strong Resale Value

SE Calgary remains a standout for family buyers — but great options exist across the city.4. Get Prepared Before the Right Home Hits the Market

Balanced markets reward organized buyers, not necessarily fast ones.5. Think Long Term

Most buyers stay in their homes 5–10 years. Over that period, rates will fluctuate, but ownership builds stability and wealth.So… Are Interest Rates Making It a Bad Time to Buy in Calgary?

Not necessarily.Here’s the real story:- Prices have softened but remain stable.

- Inventory has increased, giving buyers more choice.

- Calgary’s affordability advantage continues to attract demand.

- Future rate cuts could reignite price growth.

Internal Link for SEO

You may also like: How Long Should Your Home Search Take in Calgary? (Coming Soon)Need Help Understanding How Rates Affect Your Purchase Strategy?

If you want to know how today’s interest rates impact your affordability — or whether buying now makes sense for your long-term goals — reach out anytime for a strategy call.I’m happy to walk you through real numbers, real scenarios, and real options so you can make a confident decision in today’s Calgary market.